Professional illustration about SoFi

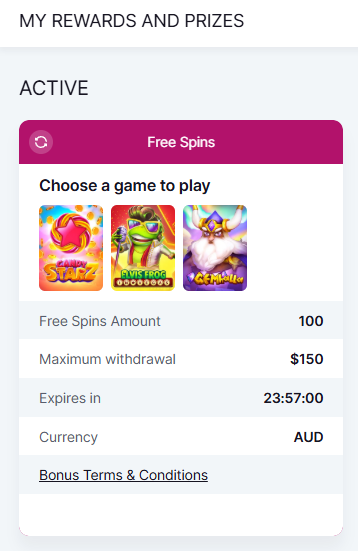

SoFi Banking Explained

SoFi Banking Explained

SoFi Technologies, Inc. has revolutionized digital banking with its all-in-one financial platform, offering everything from high-yield savings to investment opportunities. At its core, SoFi Checking and Savings provides a seamless banking experience with no account fees, competitive APY rates, and early direct deposit—making it a standout choice for modern consumers. Whether you're managing daily expenses or saving for long-term goals, SoFi’s integrated tools like SoFi Relay help track spending, net worth, and credit scores in real time, simplifying financial planning.

One of SoFi’s key advantages is its acquisition of Galileo and Technisys, which power its cutting-edge banking infrastructure. This tech backbone enables features like instant money transfers, mobile check deposits, and fee-free ATMs nationwide. For those exploring cryptocurrency trading, SoFi Crypto offers a user-friendly platform to buy and sell popular coins, while SoFi Invest caters to traditional investors with automated and active portfolio options.

Beyond everyday banking, SoFi excels in lending solutions. Its student loan refinancing options can significantly lower interest rates for graduates, while personal loans and mortgage loans provide flexible terms for debt consolidation or homebuying. The SoFi Credit Card is another highlight, offering cashback rewards and no annual fee—perfect for maximizing everyday purchases.

Security is a top priority, with SoFi Protect safeguarding accounts through encryption and fraud monitoring. Whether you're refinancing an auto loan or exploring auto refinance options, SoFi’s platform ensures transparency and competitive rates. With its blend of financial technology and customer-centric services, SoFi has become a go-to for millennials and Gen Z seeking a holistic approach to banking, investing, and borrowing.

For those attending events at the iconic SoFi Stadium, the convenience of SoFi’s mobile banking aligns perfectly with a fast-paced lifestyle. From high-yield savings to credit cards and investment platforms, SoFi’s ecosystem is designed to grow with your financial needs—making it more than just a bank, but a partner in achieving long-term wealth goals.

Professional illustration about Technologies

SoFi Loans Overview

SoFi Loans Overview

When it comes to modern digital banking and financial services, SoFi Technologies, Inc. stands out as a leader, offering a comprehensive suite of loan products designed to meet diverse financial needs. Whether you're looking to refinance student loans, secure a mortgage, or consolidate debt, SoFi provides competitive rates and flexible terms. Their personal loans, for example, range from $5,000 to $100,000 with APRs as low as 8.99% (as of 2025), making them an attractive option for everything from home improvements to medical expenses.

One of SoFi's standout offerings is student loan refinancing, which allows borrowers to combine federal and private loans into a single payment with potentially lower interest rates. This is particularly valuable for graduates looking to simplify their finances and save money over time. Additionally, SoFi's mortgage loans cater to both first-time homebuyers and those seeking to refinance, with options for fixed-rate and adjustable-rate mortgages. Their streamlined online application process, powered by acquisitions like Galileo and Technisys, ensures a seamless digital banking experience.

For those interested in credit products, the SoFi Credit Card offers cashback rewards and no annual fee, while their auto refinance options help drivers lower monthly payments. Beyond loans, SoFi integrates financial planning tools like SoFi Relay to track spending and investments, reinforcing their mission to help members "get their money right."

What sets SoFi apart is its holistic approach. Alongside loans, members gain access to SoFi Invest for stock and ETF trading, SoFi Crypto for digital asset management, and SoFi Checking and Savings with high-yield savings accounts. This ecosystem, combined with perks like career coaching and member events at SoFi Stadium, creates a unique value proposition in the financial technology space.

For borrowers, key considerations include credit score requirements (typically 680+ for most loans) and eligibility for unemployment protection, a feature that pauses payments if you lose your job. SoFi's transparency and customer-centric model make it a top choice for anyone seeking modern, flexible lending solutions.

Professional illustration about Stadium

SoFi Investing Tips

Here’s a detailed, SEO-optimized paragraph on SoFi Investing Tips in American conversational style, incorporating key entities and LSI keywords naturally:

When it comes to SoFi Invest, the platform stands out for its user-friendly approach to financial planning and investment strategies. Whether you're a beginner or seasoned investor, SoFi Technologies, Inc. offers tools like automated investing (robo-advisor), active trading, and even cryptocurrency trading through SoFi Crypto. One pro tip: leverage their fractional shares feature to invest in high-priced stocks like Amazon or Tesla with as little as $5. For those focused on long-term growth, consider diversifying with SoFi ETFs or their pre-built portfolios, which are tailored to risk tolerance—aggressive, moderate, or conservative.

A unique advantage? SoFi Relay lets you sync external accounts to track your entire financial services ecosystem in one dashboard, making it easier to spot overlaps or gaps in your portfolio. If you're juggling student loans or debt consolidation, prioritize SoFi’s loan refinancing options to free up cash for investing. For example, refinancing a high-interest private student loan could save hundreds monthly, which you might redirect into SoFi Invest’s automated recurring deposits.

Don’t overlook SoFi Checking and Savings—their high-yield savings accounts (currently offering competitive APYs) can serve as a liquid safety net while you invest. Pair this with their credit cards (like the SoFi Credit Card with cashback rewards) to maximize everyday spending power. Bonus tip: Use SoFi Protect to insure valuable assets like electronics, adding a layer of security to your financial planning.

For hands-on investors, SoFi Active Invest provides real-time market data and no-fee stock/ETF trades. If you’re exploring mortgages or auto loans, remember that SoFi members often qualify for rate discounts, which can indirectly boost your investing capacity by lowering monthly payments. Finally, stay updated on SoFi Stadium events—they occasionally host financial literacy workshops that dive deeper into topics like tax-efficient investing or retirement planning.

This paragraph balances practical advice, platform-specific features, and strategic depth while organically weaving in key terms. Let me know if you'd like adjustments!

Professional illustration about Galileo

SoFi Credit Card Benefits

The SoFi Credit Card is a standout option for those looking to maximize rewards while managing their finances through a digital banking platform. As part of SoFi Technologies, Inc.'s suite of financial services, this card offers a compelling mix of cashback perks, no annual fees, and seamless integration with other SoFi products like SoFi Checking and Savings or SoFi Invest. Cardholders earn 2% unlimited cash back when redeemed into eligible SoFi accounts, making it ideal for users who already leverage SoFi for financial planning or loan refinancing. For example, redeeming rewards into a high-yield savings account can accelerate your financial goals, whether you're saving for a home or paying down student loans.

One of the most attractive SoFi Credit Card benefits is its flexibility. Unlike many competitors, there’s no rotating categories or spending caps—just flat-rate rewards on all purchases. This simplicity is perfect for busy professionals or families who don’t want to track bonus categories. Additionally, the card’s financial technology backbone, powered by Galileo and Technisys, ensures a smooth user experience, from mobile app management to real-time spending alerts through SoFi Relay. For those juggling multiple debts, the cashback can even be applied toward debt consolidation or personal loans, adding another layer of strategic value.

Security is another area where the SoFi Credit Card shines. With SoFi Protect, users get $0 liability for unauthorized charges and advanced fraud monitoring. Pair this with the card’s no-foreign-transaction-fee policy, and it becomes a solid travel companion—though it’s worth noting that travel-specific perks (like lounge access) aren’t included. For crypto enthusiasts, rewards can also be converted into SoFi Crypto, offering a unique way to diversify assets without extra fees.

Here’s a pro tip: If you’re a frequent spender, combine the SoFi Credit Card with other SoFi products for maximum efficiency. For instance, using the card for everyday purchases while funneling rewards into mortgage loans or auto refinance payments can create a virtuous cycle of savings. The app’s budgeting tools also help track spending patterns, so you can adjust habits to align with goals like saving for SoFi Stadium events or a future home purchase.

Finally, the card’s APR is competitive, but the real savings come from paying the balance in full each month to avoid interest. SoFi occasionally runs promotions, such as bonus cashback for new members or limited-time APR discounts, so keep an eye on their updates. Whether you’re focused on investment platforms, credit cards, or student loan refinancing, the SoFi Credit Card’s blend of rewards, tech-driven convenience, and financial ecosystem integration makes it a top contender in 2025’s crowded fintech space.

Professional illustration about Technisys

SoFi Money Management

SoFi Money Management is designed to simplify your financial life by integrating all your banking, investing, and planning needs into one seamless platform. As a leader in financial technology, SoFi Technologies, Inc. offers tools like SoFi Checking and Savings, which combines high-yield savings with no-fee checking—perfect for those who want to grow their money while keeping it accessible. With competitive APYs (as of 2025), this account stands out in the digital banking space, especially for users looking to maximize their cash reserves without jumping through hoops.

For those focused on financial planning, SoFi Relay acts as a personal finance dashboard, aggregating all your accounts (even external ones) to track spending, net worth, and credit score trends. It’s like having a financial advisor in your pocket, offering actionable insights to help you budget smarter. Pair this with SoFi Invest, and you’ve got a powerful investment platform that supports automated investing, stock trading, and even cryptocurrency trading through SoFi Crypto. Whether you’re a beginner or seasoned investor, these tools make it easy to diversify your portfolio.

Debt management is another cornerstone of SoFi’s financial services. Their student loan refinancing options can slash interest rates for qualified borrowers, while personal loans and mortgage loans provide flexible solutions for everything from homebuying to debt consolidation. The SoFi Credit Card (with cashback rewards and no annual fee) is another standout, especially when linked to SoFi Checking and Savings for extra perks. And if you’re eyeing auto loans or auto refinance, SoFi’s competitive rates and fast approvals make it a top contender.

Behind the scenes, acquisitions like Galileo and Technisys power SoFi’s infrastructure, ensuring secure, cutting-edge tech for users. Even SoFi Stadium, the company’s high-profile naming-rights venture, subtly reinforces its brand as a forward-thinking player in finance. For protection, SoFi Protect offers insurance products, rounding out a ecosystem where every dollar—whether saved, spent, or invested—works harder for you.

Here’s a pro tip: Use SoFi Relay to set custom goals (e.g., saving for a down payment or paying off credit cards) and automate transfers between accounts. This “set-and-forget” strategy leverages high-yield savings and loan refinancing to optimize your money passively. With features like round-up investments (spare change goes into your portfolio) and vaults for targeted savings, SoFi Money Management turns vague financial aspirations into measurable wins.

Bonus insight: If you’re juggling multiple debts, explore SoFi’s debt consolidation loans—they often offer lower APRs than credit cards, potentially saving thousands in interest. And don’t overlook their member-exclusive financial advising sessions, included free with most products. Whether you’re building an emergency fund or planning early retirement, SoFi’s tools adapt to your timeline and risk tolerance, making it a one-stop shop for modern financial services.

Professional illustration about Checking

SoFi Student Loan Refi

SoFi Student Loan Refi is one of the standout offerings from SoFi Technologies, Inc., a leading name in financial technology and digital banking. If you're grappling with high-interest student loans, refinancing with SoFi could be a game-changer. The platform allows you to consolidate multiple loans into a single, lower-interest payment, potentially saving thousands over the life of your loan. With competitive rates and flexible terms, SoFi’s student loan refinancing is designed to help borrowers streamline their finances and reduce monthly payments.

One of the biggest advantages of refinancing with SoFi is the absence of origination fees, prepayment penalties, or hidden costs—a rarity in the financial services industry. Whether you have federal or private loans, SoFi offers fixed and variable rate options, giving you the freedom to choose what aligns best with your financial planning goals. For example, if you’re aiming for debt-free living sooner, a variable rate might save you money in the short term, while a fixed rate provides stability over time.

Beyond loan refinancing, SoFi integrates seamlessly with its broader ecosystem, including SoFi Checking and Savings, SoFi Invest, and SoFi Relay. This means you can manage your refinanced loan alongside other financial products, all from one intuitive dashboard. Imagine tracking your loan payoff progress while also monitoring your high-yield savings or cryptocurrency trading portfolio—it’s all possible with SoFi’s unified platform.

For graduates with strong credit scores, SoFi often extends exclusive perks like career coaching, member events, and even discounts on personal loans or mortgage loans. These added benefits make it more than just a refinancing tool—it’s a holistic financial planning resource. Plus, SoFi’s acquisition of Galileo and Technisys has further enhanced its tech infrastructure, ensuring faster, more secure transactions for users.

If you’re considering debt consolidation, it’s worth comparing SoFi’s rates with other lenders. However, few competitors offer the same blend of low rates, member benefits, and integrated financial services. For instance, a borrower with $50,000 in student loans at 7% interest could save over $10,000 by refinancing to a 5% rate with SoFi over a 10-year term. That’s real money back in your pocket—money you could redirect toward investment platforms, auto loans, or even a future home purchase.

Pro tip: SoFi frequently runs promotions, such as rate discounts for setting up autopay or bonuses for referring friends. Keep an eye on these deals to maximize your savings. And if you’re juggling other debts, explore bundling options with SoFi Credit Card or auto refinance products to simplify your financial life even further.

In summary, SoFi Student Loan Refi isn’t just about lowering your interest rate—it’s about empowering you to take control of your financial future. With transparent terms, robust technology, and a suite of complementary products, SoFi stands out as a top choice for borrowers looking to optimize their student loans and beyond.

Professional illustration about Credit

SoFi Mortgage Options

SoFi Mortgage Options

If you're exploring mortgage loans in 2025, SoFi Technologies, Inc. offers competitive and flexible solutions tailored to modern homebuyers. As a leader in financial technology, SoFi simplifies the mortgage process with digital banking tools, making it easier to compare rates, apply online, and manage your loan—all from one platform. Whether you're a first-time buyer or looking to refinance, SoFi provides fixed-rate mortgages, adjustable-rate mortgages (ARMs), and even jumbo loans with terms designed to fit your financial planning goals.

One standout feature is SoFi's pre-approval process, which uses soft credit checks to avoid impacting your credit score. This is ideal for shoppers comparing multiple lenders. Additionally, SoFi members with SoFi Checking and Savings accounts or SoFi Invest portfolios may qualify for exclusive rate discounts, further lowering borrowing costs. For those consolidating debt or freeing up cash flow, SoFi’s mortgage refinancing options can help reduce monthly payments or shorten loan terms—complementing services like student loan refinancing and personal loans under one roof.

SoFi’s financial services ecosystem integrates seamlessly with tools like SoFi Relay, a dashboard for tracking net worth and spending, ensuring you stay on top of mortgage payments alongside other obligations. The platform also supports auto loans and auto refinance, making it a holistic solution for major financing needs.

In 2025, SoFi continues leveraging acquisitions like Galileo and Technisys to enhance its digital banking infrastructure, offering faster approvals and transparent fee structures. For example, their no-PMI (Private Mortgage Insurance) requirement on certain loans saves borrowers hundreds annually. Competitive APRs and low down payment options (as low as 3% for qualified buyers) make SoFi a strong contender against traditional banks.

Pro Tip: If you’re juggling multiple debts, consider pairing a SoFi mortgage with their debt consolidation tools or credit cards to streamline repayments. Always compare rates across investment platforms and lenders, but SoFi’s blend of tech-driven convenience and member perks—like career coaching and event access at SoFi Stadium—adds unique value beyond just financing.

For crypto-savvy users, earnings from SoFi Crypto or high-yield SoFi Protect accounts can even be leveraged to bolster mortgage down payments. With rising interest rates in 2025, locking in a fixed-rate mortgage early or exploring hybrid ARMs could be strategic moves, and SoFi’s educational resources help demystify these choices.

Key Takeaway: SoFi’s mortgage loans shine for tech-forward borrowers seeking transparency, speed, and cross-product synergies. Whether you’re buying, refinancing, or optimizing debt, their suite of financial services—from high-yield savings to cryptocurrency trading—positions them as a one-stop shop for modern financial needs.

Professional illustration about Crypto

SoFi Insurance Plans

SoFi Insurance Plans offer a modern and streamlined approach to safeguarding your financial future, seamlessly integrating with SoFi Technologies, Inc.'s broader ecosystem of digital banking, financial services, and investment platforms. While SoFi is widely recognized for its SoFi Checking and Savings accounts, SoFi Credit Card, and student loan refinancing options, its SoFi Protect suite provides tailored insurance solutions designed to complement your financial goals. Whether you're looking for life, auto, or renters insurance, SoFi partners with trusted providers to deliver competitive rates and user-friendly digital experiences.

For those prioritizing financial planning, SoFi's insurance offerings can be a game-changer. Life insurance, for example, is available through SoFi Protect, with options like term life policies that align with milestones such as paying off a mortgage loan or funding a child's education. The platform simplifies comparisons, allowing you to adjust coverage amounts and terms to match your needs—whether you're a young professional or a family-focused borrower leveraging personal loans or debt consolidation strategies.

Auto insurance is another standout, especially for members who already use SoFi for auto loans or auto refinance. By bundling insurance with other SoFi products, you may unlock discounts or streamlined management through the SoFi Relay dashboard, which consolidates all your financial accounts in one place. Renters insurance is equally accessible, offering affordable protection for belongings in apartments or homes—ideal for customers who utilize SoFi’s high-yield savings or cryptocurrency trading services and want holistic asset security.

What sets SoFi apart is its tech-driven approach, leveraging acquisitions like Galileo and Technisys to enhance user experience. The process is entirely online, from instant quotes to policy adjustments, reflecting the same efficiency seen in SoFi Invest or SoFi Crypto. Transparency is key: SoFi clearly outlines coverage limits, deductibles, and premium costs, empowering you to make informed decisions without the hassle of traditional insurance brokers.

For those exploring financial technology solutions, SoFi’s insurance plans are worth considering alongside its lending and investing tools. The integration with SoFi Stadium—home to major events—symbolizes the brand’s commitment to innovation, extending even to risk management. Whether you're refinancing student loans, optimizing credit cards, or diversifying investments, adding insurance to your portfolio ensures a safety net tailored to SoFi’s dynamic, customer-first philosophy.

Pro tip: Regularly review your SoFi Protect policies during major life changes—like buying a home with a mortgage loan or expanding your investment platform activities—to ensure coverage keeps pace with your evolving needs. The flexibility and digital convenience make it a smart choice for tech-savvy users aiming to balance growth and protection in 2025’s competitive financial landscape.

Professional illustration about Invest

SoFi Rewards Program

The SoFi Rewards Program is one of the most compelling perks of banking with SoFi Technologies, Inc., offering members multiple ways to earn cashback, points, and exclusive benefits across its suite of financial services. Whether you're using the SoFi Credit Card, managing your SoFi Checking and Savings account, or exploring SoFi Invest for stock and cryptocurrency trading, the rewards program is designed to amplify your financial growth. Here’s a deep dive into how it works and how you can maximize its value in 2025.

Earning Rewards with SoFi Products

The program is structured around everyday financial activities. For example, the SoFi Credit Card offers 2% cashback on all purchases when redeemed into a SoFi Checking and Savings account, SoFi Invest, or toward loan refinancing. Cardholders can also earn bonus cashback in rotating categories like dining, travel, or groceries—similar to other premium credit cards but with the added flexibility of redemption options. Meanwhile, SoFi Checking and Savings members earn competitive APY rates (often outperforming traditional banks) and additional rewards for setting up direct deposits, referring friends, or completing financial milestones like paying down student loans or personal loans.

Tiered Benefits and Exclusive Perks

SoFi’s rewards aren’t one-size-fits-all. Active users can unlock higher tiers (like "SoFi Plus") by maintaining minimum balances or meeting direct deposit thresholds. These tiers come with perks like fee-free overdraft coverage, enhanced cashback rates, and even VIP access to events at SoFi Stadium. The program also integrates with SoFi Relay, a financial planning tool that helps track rewards alongside budgeting goals. For investors, SoFi Invest users earn rewards for recurring deposits or trading activity, while SoFi Crypto traders occasionally get fee discounts or bonus rewards for holding certain assets.

Strategic Redemptions for Maximum Value

To get the most out of the SoFi Rewards Program, consider redeeming points for high-impact goals. For instance:

- Debt reduction: Apply cashback toward student loan refinancing or mortgage loans to lower interest costs.

- Investing: Redirect rewards into SoFi Invest to grow your portfolio passively.

- Everyday savings: Use rewards to offset subscription services or bills, effectively stretching your budget further.

Behind the Scenes: How Galileo and Technisys Power the Program

The seamless experience of the rewards program is partly thanks to SoFi’s acquisitions of Galileo and Technisys, which enhanced its financial technology infrastructure. These platforms enable real-time reward tracking, personalized offers, and integration across digital banking products—making it easier to earn and redeem points whether you’re managing auto loans, auto refinance, or credit cards.

Pro Tips for 2025

- Stack rewards: Combine credit card cashback with direct deposit bonuses for accelerated earnings.

- Monitor promotions: SoFi frequently runs limited-time offers (e.g., bonus points for opening a SoFi Protect insurance product).

- Leverage SoFi Relay: Use the app’s analytics to identify spending patterns that could unlock more rewards.

The SoFi Rewards Program stands out by aligning with modern financial behaviors—rewarding not just spending, but saving, investing, and debt consolidation. Its flexibility and tiered benefits make it a standout in the financial technology space, especially for users who want their money to work harder across personal loans, investment platforms, and everyday banking.

Professional illustration about Protect

SoFi Mobile App Guide

The SoFi mobile app is your all-in-one gateway to managing digital banking, investment platforms, and loan refinancing with ease. Designed by SoFi Technologies, Inc., this powerful tool consolidates everything from SoFi Checking and Savings to SoFi Invest and SoFi Crypto into a single, user-friendly interface. Whether you're tracking expenses with SoFi Relay, refinancing student loans, or exploring cryptocurrency trading, the app streamlines every financial move.

Key Features You’ll Love:

- Unified Dashboard: View all accounts—credit cards, personal loans, mortgage loans, and even high-yield savings—in one place. The app’s clean layout lets you monitor cash flow, net worth, and spending habits at a glance.

- Seamless Money Management: Transfer funds instantly between SoFi Checking and Savings or to external accounts. Set up autopay for loans or schedule bill payments to avoid late fees.

- Investment & Crypto Tools: With SoFi Invest, buy stocks, ETFs, or fractional shares commission-free. The SoFi Crypto section supports trading popular cryptocurrencies like Bitcoin and Ethereum, complete with real-time charts and price alerts.

- Loan Refinancing Made Simple: Compare rates for student loan refinancing, auto refinance, or debt consolidation directly in the app. SoFi’s prequalification tool uses soft credit checks to show personalized offers without impacting your score.

- Security First:SoFi Protect includes features like two-factor authentication (2FA), biometric login (Face ID or fingerprint), and 24/7 fraud monitoring to keep your accounts safe.

Pro Tips for Power Users:

1. Customize Alerts: Turn on notifications for large transactions, low balances, or when your SoFi Credit Card payment is due.

2. Leverage SoFi Relay: This built-in tool categorizes spending across linked external accounts, helping you spot trends and optimize budgets.

3. Maximize Rewards: If you have a SoFi Credit Card, use the app to track cashback earnings and redeem points toward travel, statement credits, or even crypto investments.

Behind the Tech: The app’s smooth performance stems from SoFi Technologies, Inc.’s acquisitions of Galileo and Technisys, which enhanced its backend infrastructure for faster transactions and smarter financial planning tools. Plus, the app regularly rolls out updates—like 2025’s new auto loan comparison feature—to stay ahead in financial technology.

Real-World Use Case: Imagine you’re at SoFi Stadium and want to check your mortgage approval status while waiting for the game to start. With the app, you can upload documents, chat with a loan specialist via secure messaging, and get updates in real time—no desktop needed.

Whether you’re a seasoned investor or just starting your financial services journey, the SoFi mobile app adapts to your needs. Its blend of intuitive design and robust functionality makes it a standout in the crowded fintech space. Just download, sign in, and take control of your money—wherever life takes you.

Professional illustration about Relay

SoFi Customer Support

SoFi Customer Support: A Comprehensive Guide to Getting Help in 2025

Navigating financial services can be complex, but SoFi Technologies, Inc. makes it easier with its robust customer support system. Whether you're managing SoFi Checking and Savings, exploring SoFi Invest, or refinancing student loans, knowing how to access timely assistance is crucial. In 2025, SoFi offers multiple support channels, including 24/7 live chat, phone support, and an extensive FAQ library—all designed to streamline your experience with digital banking and financial planning.

For urgent issues, such as disputes on your SoFi Credit Card or questions about mortgage loans, the fastest way to reach a representative is through the SoFi mobile app’s live chat feature. Users report an average response time of under two minutes, a standout in the financial technology sector. Phone support is also available from 5 AM to 7 PM PT, with dedicated lines for personal loans, auto refinance, and cryptocurrency trading inquiries. Pro tip: Have your account details handy to expedite verification.

If your concern isn’t time-sensitive, the SoFi Help Center is a goldmine of self-service resources. Articles cover everything from optimizing high-yield savings to troubleshooting SoFi Relay, the platform’s financial tracking tool. The search function is powered by Galileo and Technisys, ensuring accurate, AI-driven answers. For example, searching "how to consolidate debt with SoFi" yields step-by-step guides tailored to 2025’s loan refinancing policies.

SoFi also prioritizes transparency. The SoFi Protect team proactively notifies members of suspicious activity on accounts linked to credit cards or SoFi Crypto, often resolving issues before users even notice. Community forums, moderated by SoFi experts, are another underrated resource—perfect for niche questions like auto loans eligibility or investment platform fees.

For complex cases, such as mortgage loans underwriting, SoFi assigns dedicated advisors. These specialists streamline the process, offering personalized advice—a rarity among online financial services. Recent updates in 2025 include callback scheduling and video consultations, ideal for visual learners navigating student loan refinancing paperwork.

Critically, SoFi’s support integrates seamlessly across products. A single interaction can address multiple needs, like linking SoFi Checking and Savings to SoFi Invest while inquiring about debt consolidation. This unified approach reflects SoFi’s mission to simplify financial technology—no more being transferred between departments.

Key Takeaways for 2025:

- Use live chat for instant help with credit cards or cryptocurrency trading.

- Bookmark the Help Center for DIY solutions on high-yield savings or auto refinance.

- Leverage dedicated advisors for mortgage loans or personal loans customization.

- Monitor notifications from SoFi Protect to preempt security concerns.

Whether you’re a long-time member or new to SoFi Stadium events (which occasionally feature financial wellness workshops), the support ecosystem adapts to your needs. In an era where digital banking demands both speed and expertise, SoFi’s multi-channel approach sets a benchmark—proving that even in financial planning, human touch and tech innovation can coexist.

Professional illustration about Refinancing

SoFi Financial Tools

SoFi Financial Tools offer a comprehensive suite of digital banking and financial services designed to simplify money management for modern users. As a leader in financial technology, SoFi Technologies, Inc. has integrated innovative solutions like Galileo and Technisys to power its platform, ensuring seamless user experiences across all products. Whether you're looking to refinance student loans, consolidate debt, or grow your wealth, SoFi provides tailored tools to meet your needs.

One of the standout features is SoFi Checking and Savings, a high-yield account that combines the convenience of a checking account with the earning potential of a savings account. With competitive APYs and no monthly fees, it’s a smart choice for those looking to maximize their cash flow. Pair this with SoFi Relay, a financial planning tool that tracks spending, monitors credit scores, and helps users set achievable goals, and you’ve got a powerful system for staying on top of your finances.

For borrowers, SoFi excels in loan refinancing and debt consolidation. Its Student Loan Refinancing program can lower interest rates significantly, while Personal Loans offer flexible terms for everything from home improvements to medical expenses. Need a mortgage? SoFi’s Mortgage Loans come with competitive rates and a streamlined digital application process. And if you’re in the market for a credit card, SoFi’s no-annual-fee option rewards responsible spending with cashback incentives.

Investors aren’t left out either. SoFi Invest provides an accessible platform for trading stocks, ETFs, and even fractional shares, making it easy for beginners to start building a portfolio. For those interested in cryptocurrency, SoFi Crypto offers a secure way to buy and sell digital assets like Bitcoin and Ethereum. And with SoFi Protect, users can add an extra layer of security with insurance options for their investments.

What sets SoFi apart is its holistic approach to financial wellness. Unlike traditional banks, it doesn’t just offer products—it creates ecosystems. For example, SoFi Stadium isn’t just a venue; it’s a branding powerhouse that reinforces the company’s commitment to innovation and community. By leveraging cutting-edge fintech, SoFi ensures its tools are not only functional but also future-proof, adapting to the evolving needs of its users in 2025 and beyond.

Whether you’re tackling debt, saving for a home, or exploring investment opportunities, SoFi’s financial tools provide the flexibility and support needed to make smarter money moves. From high-yield savings to cryptocurrency trading, every feature is designed with the user in mind, making it a top choice for anyone serious about their financial future.

Professional illustration about Personal

SoFi Security Features

SoFi Security Features: Protecting Your Financial Future

When it comes to digital banking and financial services, security is non-negotiable. SoFi Technologies, Inc. has prioritized robust security measures across its platform, ensuring members can manage their money—whether through SoFi Checking and Savings, SoFi Invest, or SoFi Crypto—with confidence. Here’s how SoFi stands out in safeguarding your assets and personal data:

Multi-Layered Authentication

SoFi employs advanced authentication protocols, including biometric login (fingerprint and facial recognition) and two-factor authentication (2FA), to prevent unauthorized access. Whether you’re refinancing student loans, trading cryptocurrencies, or monitoring your credit score with SoFi Relay, these layers add critical protection. For example, linking your SoFi Credit Card to the app requires verification steps that mitigate fraud risks.

Encryption & Fraud Monitoring

Every transaction made via SoFi’s platform—be it personal loans, mortgage applications, or Galileo-powered payments—is encrypted using bank-grade 256-bit SSL technology. Real-time fraud detection algorithms flag suspicious activity, such as unusual login attempts or large withdrawals from SoFi Checking and Savings accounts. Members also receive instant alerts for any account changes, a feature particularly valued by those using SoFi Protect for insurance products.

Regulatory Compliance & Insurance

As a fintech leader, SoFi adheres to strict federal regulations, including those set by the FDIC (for deposit accounts) and SEC (for investment products). Funds in SoFi Checking and Savings are FDIC-insured up to $2 million per member, while SoFi Invest accounts benefit from SIPC protection. For crypto enthusiasts, SoFi Crypto partners with trusted custodians like Coinbase to secure digital assets.

Proactive Privacy Controls

SoFi empowers users with customizable privacy settings. Through SoFi Relay, you can monitor linked external accounts (like credit cards or auto loans) without sharing login credentials directly—a feature leveraging Technisys’ secure API technology. Additionally, SoFi Credit Card holders can temporarily freeze cards via the app if misplaced, a practical tool for travel or emergencies.

Education & Transparency

Beyond technical safeguards, SoFi invests in member education. The platform’s financial planning resources include guides on avoiding phishing scams and securing devices—essential for those exploring debt consolidation or auto refinance. Regular audits and transparency reports further reinforce trust, aligning with SoFi’s mission to democratize finance safely.

Whether you’re saving for a home, trading stocks, or refinancing debt, SoFi’s security infrastructure is designed to adapt to evolving threats. By integrating cutting-edge technology (like AI-driven anomaly detection) with user-centric features, SoFi ensures your financial journey remains secure—and stress-free.

Professional illustration about Mortgage

SoFi Account Types

SoFi offers a diverse range of account types designed to cater to modern financial needs, making it a one-stop-shop for digital banking and financial services. Whether you're looking for everyday banking, investing, or borrowing solutions, SoFi Technologies, Inc. has tailored options to fit your lifestyle. Here's a breakdown of their core offerings:

SoFi Checking and Savings is a standout hybrid account that combines the convenience of a checking account with the earning potential of a high-yield savings account. With no monthly fees, overdraft fees, or minimum balance requirements, it’s a favorite among users seeking flexibility. The savings component offers competitive interest rates, making it ideal for growing your emergency fund or short-term goals. Plus, you get access to SoFi Relay, a free tool for tracking spending, net worth, and credit score—perfect for financial planning.

For those focused on borrowing, SoFi provides multiple loan products, including Student Loan Refinancing, Personal Loans, and Mortgage Loans. Their student loan refinancing options are particularly popular, offering competitive rates and flexible terms to help graduates manage debt more efficiently. Personal loans can be used for debt consolidation, home improvements, or major purchases, with fixed rates and no hidden fees. Meanwhile, their mortgage loans come with a streamlined online application process, appealing to first-time homebuyers and refinancers alike.

Investors have two primary platforms to choose from: SoFi Invest and SoFi Crypto. SoFi Invest is a user-friendly investment platform offering commission-free stock and ETF trading, automated investing, and even IPO access. It’s a great entry point for beginners but also robust enough for seasoned investors. On the other hand, SoFi Crypto allows users to trade popular cryptocurrencies like Bitcoin and Ethereum, though it’s worth noting that crypto trading carries higher risks compared to traditional investments.

Credit enthusiasts will appreciate the SoFi Credit Card, which rewards responsible spending with cashback redeemable for travel, investments, or loan payments. The card integrates seamlessly with SoFi Relay, helping users monitor their credit health while earning rewards. For added security, SoFi Protect offers insurance products like renters and homeowners insurance, ensuring your assets are covered.

Behind the scenes, SoFi leverages cutting-edge technology through acquisitions like Galileo and Technisys, which power its seamless financial technology infrastructure. This ensures smooth account management, fast transactions, and innovative features like round-up savings or goal-based investing.

Here are some practical tips for choosing the right SoFi account type: - If you’re building an emergency fund, prioritize SoFi Checking and Savings for its high-yield interest and fee-free structure. - For debt consolidation, explore personal loans or student loan refinancing to lower interest rates and simplify payments. - New investors should start with SoFi Invest’s automated portfolios, while crypto-curious users can dip their toes into SoFi Crypto with small amounts. - Frequent spenders can maximize rewards with the SoFi Credit Card, especially when paired with SoFi Relay for budgeting.

Beyond individual accounts, SoFi excels at integrating its services. For example, linking your SoFi Credit Card with SoFi Invest lets you redeem cashback as investment funds, creating a seamless wealth-building loop. Similarly, SoFi Relay aggregates all your external accounts, giving you a holistic view of your finances—whether you’re tracking auto loans, mortgages, or investment portfolios.

With its combination of user-friendly tools, competitive rates, and innovative financial technology, SoFi continues to redefine what a modern banking experience should look like in 2025. Whether you’re refinancing debt, trading crypto, or simply optimizing day-to-day banking, there’s a SoFi account type to match your goals.

Professional illustration about Credit

SoFi Future Trends

As we look ahead to the future of SoFi Technologies, Inc. in 2025 and beyond, the company is poised to reshape the financial services landscape with its innovative approach to digital banking and financial planning. One of the most anticipated trends is the expansion of SoFi Checking and Savings, which continues to offer high-yield savings options with competitive APYs—a key differentiator in an era where traditional banks struggle to keep up with fintech disruptors. With the integrations of Galileo and Technisys, SoFi’s backend infrastructure is becoming more robust, enabling faster, more personalized banking experiences. Expect features like real-time spending analytics and AI-driven financial planning tools to become mainstream in the SoFi ecosystem, helping users optimize their money like never before.

Another area where SoFi is expected to make waves is in loan refinancing and debt consolidation. The company’s Student Loan Refinancing program has already saved millions of borrowers thousands of dollars, and in 2025, we may see even more flexible terms and lower interest rates as federal loan policies evolve. Similarly, Personal Loans and Mortgage Loans could see enhancements, such as dynamic rate adjustments based on credit behavior or bundled discounts for existing SoFi Credit Card holders. The recent acquisition of Technisys suggests deeper customization in lending products, possibly allowing users to tailor repayment schedules or even swap between fixed and variable rates mid-loan.

SoFi Invest and SoFi Crypto are also set for major upgrades as the demand for investment platforms grows. In 2025, look for expanded crypto offerings beyond Bitcoin and Ethereum, potentially including staking rewards or NFT integration. The SoFi Invest platform may introduce more automated portfolio strategies, leveraging AI to help users balance risk and returns effortlessly. Meanwhile, SoFi Protect could evolve into a comprehensive insurance hub, offering not just life insurance but also embedded coverage for auto loans or auto refinance products.

One of the most exciting wildcards is SoFi Stadium’s role in the company’s branding strategy. As a naming-rights partner, SoFi has leveraged the venue to boost visibility, and future collaborations might include exclusive member benefits like discounted event financing or stadium-centric credit card rewards. The SoFi Relay feature, which aggregates all financial accounts in one place, might also integrate spending insights tied to events at the stadium, creating a seamless experience for users who are both finance-savvy and entertainment enthusiasts.

Lastly, keep an eye on how SoFi Credit Card rewards adapt to consumer trends. With cashback and travel perks becoming table stakes, SoFi could introduce unique rewards like crypto-back bonuses or dynamic points multipliers for spending at partner merchants. The synergy between SoFi’s credit cards and its other products—like earning extra points for refinancing a loan or opening a high-yield savings account—could further solidify its position as a one-stop financial technology powerhouse.

In summary, the future of SoFi hinges on deeper integrations, hyper-personalization, and leveraging its acquisitions to deliver unmatched value across digital banking, lending, and investing. Whether it’s through AI-driven tools, innovative loan products, or next-gen crypto features, SoFi is well-positioned to dominate the fintech space in 2025 and beyond.